How Crowdfunding Campaigns Enhance Business Funding While Building Your Brand

Wiki Article

Discovering Effective Company Funding Options for Consultants: A Comprehensive Overview

Maneuvering the landscape of organization financing can be a pivotal obstacle for experts. With various alternatives offered, from standard fundings to cutting-edge crowdfunding platforms, each presents unique advantages and possible mistakes. Consultants must analyze their specific needs and monetary conditions to figure out the most appropriate path. As the need for effective financing approaches grows, recognizing how to leverage these sources comes to be essential for sustainable success. What choices will shape their future?Comprehending Conventional Loans for Consultants

Steering the landscape of standard fundings can be important for experts seeking to fund their organization endeavors. These loans usually offer a structured technique to safeguarding capital, which can be crucial for various functional needs, consisting of tools purchases, marketing efforts, or employing staff - Business Funding. Professionals frequently rely upon banks or lending institution, where they can access term car loans or credit lines tailored to their monetary accounts. To qualify, a professional must show credit reliability, typically with credit history and monetary statements, which reflect their ability to settle the funding. Rate of interest and settlement terms differ, making it significant for experts to contrast deals carefully. In addition, recognizing the ramifications of security demands can influence finance choices. On the whole, standard car loans offer a feasible funding alternative for professionals who are prepared to browse the intricacies of the application procedure and satisfy lending institution assumptionsExploring Grant Opportunities for Consulting Projects

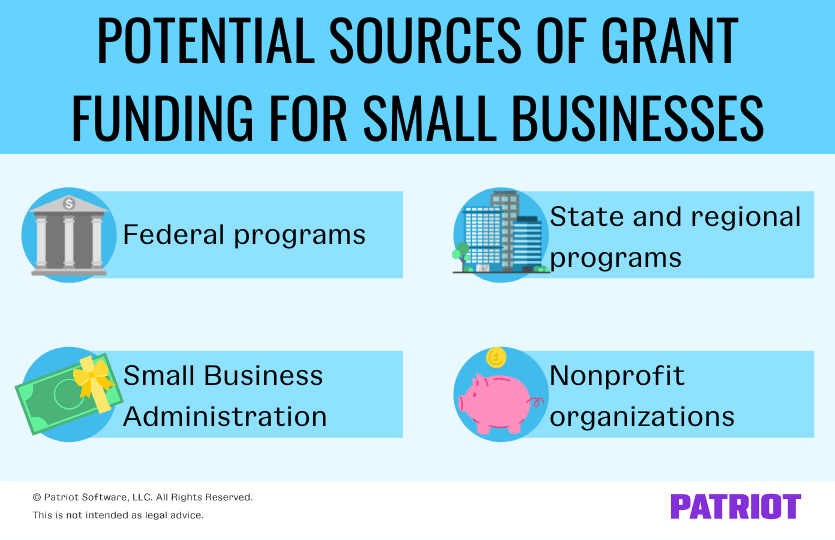

For specialists looking for option funding methods, checking out give chances can be a beneficial method. Grants, typically provided by government entities, structures, and not-for-profit organizations, can provide economic assistance without the concern of settlement. These funds can be particularly designated for jobs that advertise technology, area growth, or sector-specific campaigns, making them especially advantageous for experts concentrated on impactful work.Consultants should begin by determining gives relevant to their experience or target audience. This entails looking into readily available chances, recognizing qualification requirements, and lining up project goals with give objectives (Business Funding). In addition, crafting an engaging proposal is crucial, highlighting the project's prospective advantages and outcomes

The Power of Crowdfunding in the Consulting Sector

Traditional financing sources remain preferred, many consultants are significantly transforming to crowdfunding as a viable option to finance their jobs. This innovative financing technique enables professionals to provide their concepts to a wide target market, allowing them to collect financial backing from people that think in their vision. Systems like Kickstarter and Indiegogo give an area for professionals to display their expertise and the worth of their solutions, attracting both large and little financiers.Crowdfunding not just elevates resources but likewise works as an advertising and marketing device, helping professionals construct a neighborhood around their brand name. Engaging possible customers early while doing so creates valuable links and insights that can form job development. In enhancement, effective campaigns can boost trustworthiness, showcasing a consultant's ability to draw in passion and assistance for their campaigns. As the consulting landscape evolves, crowdfunding becomes a vibrant and efficient funding technique for enthusiastic specialists.

Alternative Funding Techniques for Rapid Development

Just how can experts leverage alternative funding approaches to achieve rapid development? Professionals can explore options such as peer-to-peer loaning, billing financing, and revenue-based financing. Peer-to-peer lending systems attach professionals with individual investors, providing quicker accessibility to capital without typical financial institution examination. Billing funding allows professionals to obtain prompt funds versus superior invoices, improving capital and allowing financial investment in growth techniques. Revenue-based funding helpful hints supplies resources in exchange for a portion of future earnings, aligning the funding terms with the consultant's earnings stream.

In addition, experts may take into consideration partnerships with capitalists who give funds for equity, supplying not simply capital however likewise beneficial sector links. These alternate funding options can be tailored to meet certain organization needs, assisting in a fast-tracked growth trajectory while reducing threat. By strategically making use of these techniques, experts can properly place themselves for growth and boosted market competition.

Choosing the Right Funding Choice for Your Working as a consultant

Professionals need to assess numerous funding choices to locate the finest fit for their special business requirements. Factors such as business phase, development capacity, and financial health and wellness play crucial functions in this decision-making procedure. For established professionals, standard small business loan might give favorable terms, while more recent companies could think about individual financial savings or crowdfunding to reduce monetary danger.Equity funding can also be an alternative, permitting specialists to bring in companions who share their vision, yet this might dilute possession. Furthermore, government grants and aids use non-repayable funding, albeit with rigorous eligibility requirements.

Consultants must likewise check out alternative funding techniques, such as invoice factoring or credit lines, which can provide quick access to capital. By assessing each choice's obstacles and advantages, experts can make informed choices that line up with their financial technique and long-term objectives.

Regularly Asked Concerns

What Are the Risks Connected With Different Financing Options?

The risks connected with different financing options include high-interest rates, equity dilution, repayment responsibilities, potential loss of control, and reliance on fluctuating market problems. Each funding source brings special difficulties that need careful consideration by services.How Can I Boost My Opportunities of Securing Funding?

To improve possibilities of safeguarding funding, one must create a solid business plan, demonstrate a clear worth proposal, build a solid credit score profile, network efficiently, and get ready for comprehensive due diligence by possible financiers or loan providers.What Is the Common Timeline for Funding Approval?

The normal timeline for funding approval differs, typically ranging from a few weeks to numerous months (Business Funding). Elements influencing this timeline consist of the financing source, application completeness, and the complexity of the proposed organization strategyExist Details Funding Options for Particular Niche Consulting Areas?

Yes, particular niche consulting areas frequently have particular financing choices, including gives tailored to specialized sectors, endeavor capital focused on innovative options, and crowdfunding platforms that satisfy special company proposals within those niches.Exactly How Can I Manage Capital After Getting Financing?

To take care of cash money circulation after getting funding, one must develop a comprehensive budget plan, display costs carefully, prioritize essential expenses, establish a get for emergency situations, and frequently review monetary estimates to adjust to transforming scenarios.Navigating the landscape of business funding can be a pivotal challenge for consultants. For experts looking for great site alternative funding methods, exploring give possibilities can be a beneficial approach. Typical financing resources remain popular, numerous specialists are increasingly turning to crowdfunding as a practical choice to finance their jobs. Consultants can check out choices such as peer-to-peer lending, billing financing, and revenue-based financing. Consultants must examine numerous funding options to locate the discover here finest fit for their unique organization needs.

Report this wiki page